Macroeconomics & News

In this lesson we will examine:

– Data that has a significant impact on markets

– Consumer prices and inflation

– Economic growth and its effects on investments

– Resources for finding upcoming news

Fundamental analysis concerns macroeconomic data and news releases. Some data has more impact than others, as we will examine below.

Additionally, some data releases or unexpected events that take the market by surprise – either failing to reach or exceeding expectations – can cause considerable market volatility.

Let’s start with some key macroeconomic indicators which can drive the market.

Employment Numbers

One of the most important indicators of the strength of an economy is the employment rate. Employment rates affect the whole economy of a country, from purchasing power to economic output and GDP.

An increase in unemployment rates is interpreted by the financial markets as a sign that a country’s economy is deteriorating negatively. This may give currency traders evidence that investors might divest themselves from the currency of the affected country.

It may also provide clues that capital flight will occur to other currencies, or to so-called “safe havens” such as gold, government bonds of another country or “defensive stocks” (which include utility providers, healthcare, biotechnology, and consumer goods companies).

Non-Farm Payrolls

The highest impact macroeconomic release every month are the US non-farm payroll announcements (known to traders as “NFP”). Non-farm payrolls are released every month, on the first Friday, at approximately 2:30 pm. The figures show newly created jobs in the non-agricultural sector, and the unemployment rate for the previous month.

Consumers make up nearly 70% of US economic activity, so the state of the labour market is of paramount importance to the overall well-being of the country. Better than expected NFP numbers indicate the US labour market is strengthening, improving the prospects for the US economy, and could thus have a positive effect on the US Dollar and US stocks.

Conversely, worse than expected NFP numbers may lead to a weaker US Dollar and lower US stock prices. It could also cause capital flight to safe havens, as we have just seen.

Because the US Dollar is the world’s reserve currency, the effects of NFP news announcements can even affect volatility and price movements on non-US Dollar currency pairs.

Many professional retail traders take the day off from trading on NFP Fridays. Markets can often be range-bound leading up to the announcement, and we strongly recommend avoiding trading during the announcement and in the aftermath, due to spreads widening dramatically and the markets rapidly fluctuating, often moving dozens of pips in either direction in a very short space of time.

Inflation

Central Banks seek stable prices in the economy, measured by investors via changes in inflation. Inflation reports are therefore important as they can provide clues as to the future intentions and policy of the Central Banks.

The Consumer Price Index (CPI) is a very important potential indicator of inflation. CPI measures a basket of goods and services and tracks the rise of prices.

When CPI data is higher than expected, inflation pressure is greater, so a Central Bank could potentially raise interest rates, which could lead to an appreciation in the value of the currency.

Conversely, a low rate of inflation might be countered with lower interest rates, which could lead to a currency depreciating in value.

Gross Domestic Product

Gross Domestic Product (GDP) – is the broadest indicator of a country’s economy and shows total market value for all goods and services produced in a given year. GDP impacts personal finance, investments and job growth.

Strong GDP numbers show a generally healthy economy, whereas if there are two consecutive quarters of economic decline, and a rise in unemployment, many investors would regard that as a sign of an economy entering into a recession. If a recession lasts three or more years or experiences a decline in GDP of at least 10% in a given year, then this is generally regarded by investors as a depression.

GDP numbers can be useful to Forex traders, precious metal traders, oil traders and also those trading stock indices, such as the FTSE100, DAX and SP500.

Resources

Macroeconomic data is published very regularly, but not all of it is relevant and some of it has little to no impact on markets.

Below are two websites that are free to use and that can be accessed at any time to see upcoming news or data releases and their expected impact (please note, we are not responsible for third-party content):

– Forex Factory Calendar

– MyFXBook Economic Calendar

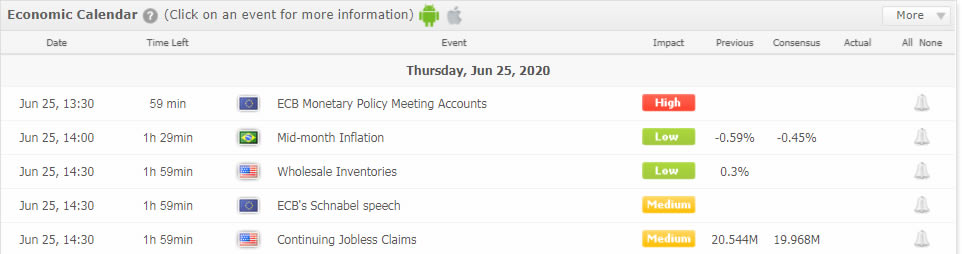

Using MyFXBook’s calendar as an example, as you can see from the below screenshot, every news announcement is given an “impact” rating, along with the time of the announcement. The times are automatically adjusted to the time of your computer or phone.

There are four types of impact rating:

None – These are generally notifications of public holidays. Although there may not be excess volatility to be concerned about, volatility may be much lower than normal and may make trading currencies in countries where banks are closed for the holiday more difficult, due to ranging markets.

Low – These news announcements are expected to have minimal impact on the currency pairs.

Medium – Medium impact news is generally still tradeable, but it is worth keeping in mind that the markets may suddenly move against the trend, if only briefly.

High – These announcements are generally avoided by professional retail traders. Your orders may not get filled, the spreads can widen enormously and the markets can rise and fall dozens (and sometimes hundreds) of pips in just a few seconds. Although some retail traders attempt to trade high impact news announcements, we strongly recommend against it.

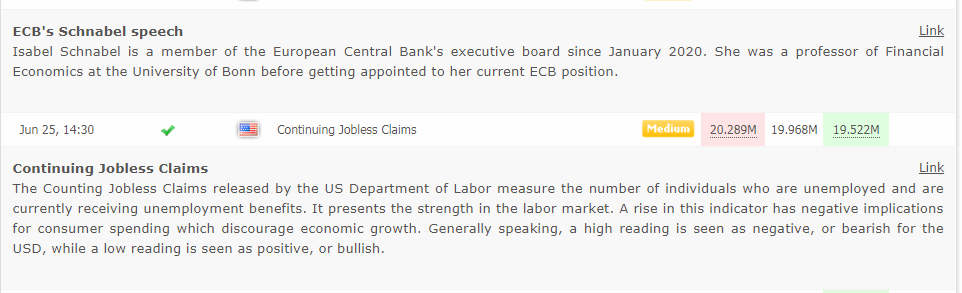

In addition to the times of the announcements, clicking on each news item provides additional information about the news, which can greatly assist you in making trading decisions:

As you can see, these tools make it easy to research and plan for your trading times, and give you a good indication of when not to trade certain currencies or other instruments at all.

As you can see, these tools make it easy to research and plan for your trading times, and give you a good indication of when not to trade certain currencies or other instruments at all.