Market Sentiment

In this lesson we will explore:

– How market sentiment can be used in your fundamental analysis

– How to measure sentiment

– What can be learned from data on open positions

– How market sentiment can assist your trading

Markets are often driven by emotion, primarily fear of losing and greed in making profits, rather than economic reasons.

Although prices of assets depend mainly on fundamental and technical factors, they can also be influenced by market sentiment. Sentiment can be thought of as the mood of the market, and this mood can be reflected in prices.

In 2016, for example, the market reacted nervously to Donald Trump’s win in the US presidential. The majority of political polls predicted a victory for Hillary Clinton, and the markets tumbled when Trump emerged as the winner. There was a sell-off of the US Dollar and indices, but soon after, traders began to back the Dollar and US stocks.

The market came to realized that Trump’s policies were likely beneficial to the US economy, but the initial reaction was determined mainly by sentiment, not by fundamental factors.

It is important to take sentiment into consideration when trading, and to be aware of indicators that could be helpful in this area.

Market Sentiment

Market sentiment is defined as the majority attitude of investors toward a particular asset or the market as a whole. The majority of traders may be bullish about a market, bearish, or if there is no overall consensus, the sentiment can be defined as neutral.

When a bearish mood prevails, stocks are likely to fall in price. On the other hand, a bullish view is a positive one that may lead to stock prices rising.

The same applies to currency trading, although as we will see, this is more difficult to establish.

Measuring Sentiment

Measuring sentiment is difficult. In the markets, every trader has their own opinion, and everyone is looking for an edge to their trading. However, there are several public domain websites that reflect the overall sentiment of market participants.

Two of these for the stock market are as follows.

AAII Bull and Bear

– The AAII investor sentiment survey is a popular survey in regards to the US Stock market. It is conducted among AAII members that answer the same question each week as they have since 1987: are they bullish, bearish or neutral on US stocks.

The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of investors:

The AAII Investor Sentiment Survey is widely followed. The weekly survey results are published on websites such as Bloomberg and are monitored closely by traders.

You can see the weekly sentiment at the AAII website

(Please note, we are not responsible for third-party content)

CNN Fear and Greed Index

The CNN Fear and Greed Index is not based on a survey of investors, but instead takes into account other markets and indices, for example the Chicago Board Options Exchange (CBOE) Volatility Index (VIX). The results are shown on a scale from 0 to 100. The higher the reading, the greedier investors are regarded. A level around 50 is seen as neutral.

You can view the CNN Fear and Greed Index on the CNN Money website

(Please note, we are not responsible for third-party content)

Open Positions

The directional bias of open positions – long and short – is another indicator of market sentiment. A bullish, bearish or neutral view of markets can be seen in the number of opened longs or shorts in a specific currency, commodity or index .

For example, if a report shows a solid increase in long positions in the US Dollar, that means that the market’s outlook is bullish on the currency.

The most important reports on open positions are the Commodity Futures Trading Commission (CFTC) “Commitments of Traders’”reports.

These reports provide a breakdown of each Tuesday’s open interest for markets in which twenty or more traders hold positions equal to or above the report levels established by the CFTC.

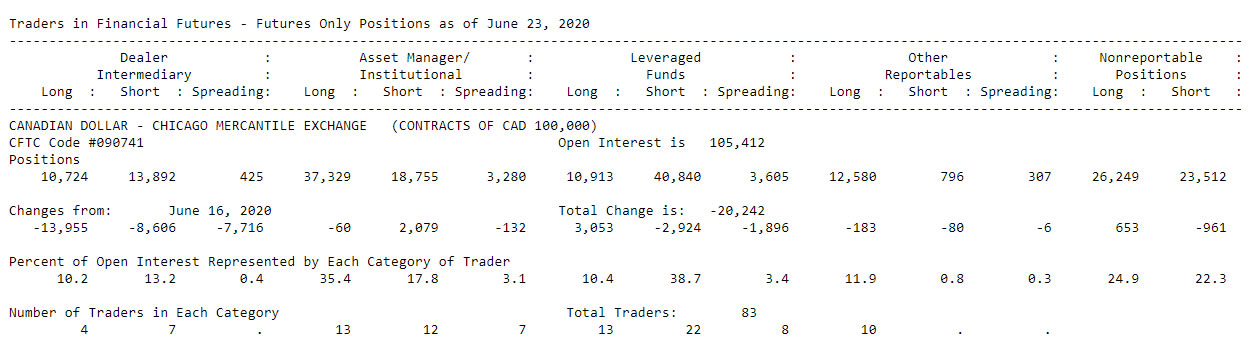

CFTC reports essentially show the net long or short positions for each available futures contract for three different types of traders: commercial traders, non-commercial traders and non-reporting traders. A typical report looks like this:

You can view each weekly report at the CTFC website

Traders interested in data related to CFD commodities should look at reports on the website as shown in the image below:

US indices CFD traders and Forex traders should look at the report on the website as shown in the image below:

Unfortunately, this data represents some of the best available to Forex traders. Because Forex is a decentralized exchange, the volume and data you may see in MT4 sentiment indicators only reflects the data of your brokerage. It does not show the sentiment of traders using other brokerages, and does not factor in data from large financial institutions such as banks or hedge funds.

Incorporating Sentiment in Trading

As you can see, sentiment is a type of fundamental analysis – mainly on a shorter term rather than the longer term. The golden rule of sentiment is that the more something is known about a market, the less of an impact it will generally have. Keep this in mind when identifying the sentiment and the expected market reaction.

Just like the moods of individual people, sentiment in the markets can change quickly, and for a variety of reasons.

The best sentiment trades happen when the current sentiment of the trading session is in line with the big picture fundamentals and technicals.

These are great trades because you have the power of the longer term investors who are using the fundamentals and the shorter term institutional traders using the current sentiment to get into (or out of ) their trades. Together they are all pushing price in the same direction, which can make for great price action and trends to take advantage of.

There are no mechanical rules regarding how to trade sentiment. Trading sentiment is more of skill that is honed and perfected by spending time with the market and getting to know its moods and behaviours when certain events occur.

Sentiment can last for an hour, a day, or even months depending on what is causing it and how relevant the market believes the cause for the sentiment is to the current economic situation. As we saw with the election of Donald Trump in the example at the start of this lesson, market expectation of an event is what creates the initial sentiment. Once the news is out, the market will then create a new sentiment based on the new situation.

Additionally, the market reaction to a certain event can be quite strong, but if a few weeks later the exact same scenario occurs, the market is likely to show almost no reaction at all. The Forex market in particular tends to become desensitized to events if they occur again.

Finally, sentiment can also be used as a counter-trend when sentiment and fundamentals/technicals oppose each other. These are known as counter-sentiment or contrarian trading opportunities .

An example of counter-sentiment trading opportunities might look like the following:

If fundamentals are positive and sentiment is negative, the negative sentiment could lower price down to a point at which it makes fundamental and technical sense to start buying again in line with the big picture. In other words, negative sentiment has made the price too cheap and you can now buy the dip – once the negative sentiment fades, traders will also realize the price is too low and the price will begin to rise again.

Final Thoughts

Market sentiment can be a helpful tool in analysing markets. It could act as a reversal indicator, but could also show that a recent move will continue. It can also be used to assess areas where price is too low relative to all the other known data about a market and signify a contrarian position. However, sentiment and open position indicators are lagging ones, which means they may signal a move that has already occurred.

Sentiment should be considered as an additional tool to your existing fundamental and/or technical analysis, and not the sole method for analysing a market’s behaviour.