Commodities

In this lesson we will examine:

– The definition of a commodity

– How fundamentals move commodity prices

– Seasonality and other factors in the price of commodities

Commodities are a unique sector within financial markets. As we have seen in a previous lesson, commodities are highly sensitive to the dynamics of supply and demand. Commodity prices are also affected by economic factors and consumer habits, and prices can fluctuate as a result in changes to these factors.

Commodity Definition

A commodity is usually a natural resource that can be processed and sold. These include raw agricultural products, metals, energies, minerals, and more.

The sale and purchase of commodities is usually carried out through standardized futures contracts on different exchanges.

A futures contract is a type of derivative instrument, or financial contract, in which two parties agree to transact a set of financial instruments or physical commodities for future delivery at a particular price. If you buy a futures contract, you are basically agreeing to buy something that a seller has not yet produced for a set price.

The prices of these futures contracts form the basis for many commodity CFDs.

Some of the biggest futures exchanges in the world for commodity trading now follow.

CME Group

The Chicago Mercantile Exchange (CME) is a global commodity and derivatives marketplace based in Chicago.

The Chicago Mercantile Exchange (CME) is a global commodity and derivatives marketplace based in Chicago.

The Chicago Board of Trade (CBOT) merged with the Chicago Mercantile Exchange (CME) in 2007 to form the CME Group.

In 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX), Commodity Exchange, Inc (COMEX). CME, CBOT, NYMEX, and COMEX are now markets that are all owned by the CME Group.

The CME specializes in Livestock and Meat, such as Lean Hogs and Live Cattle, as well as forestry products such as Lumber and Pulp.

CBOT markets include Corn, Oats, Rough Rice, Soybeans and Ethanol.

NYMEX offerings include WTI Crude Oil, Natural Gas, Platinum and Palladium.

The COMEX deals with metals, namely Gold, Silver, Copper and Aluminium.

Intercontinental Exchange

The Intercontinental Exchange (ICE) is an American company that owns exchanges for financial and commodity markets, and operates twelve regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets.

The Intercontinental Exchange (ICE) is an American company that owns exchanges for financial and commodity markets, and operates twelve regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets.

ICE mainly deals in Coffee, Cocoa, Cotton Sugar, Crude and Refined Oil, Electricity and UK Natural Gas.

London Metal Exchange

The London Metal Exchange (LME) is a futures exchange with the world’s largest market in options and futures contracts on base and other metals.

The London Metal Exchange (LME) is a futures exchange with the world’s largest market in options and futures contracts on base and other metals.

Despite being a global leader in metals,the LME does not deal in gold or silver – these are traded on the London Bullion Market, by the members of the London Bullion Market Association

The LME offers futures and options contracts for Aluminium, North American Special Aluminium Alloy, Cobalt, Copper, Lead, Molybdenum, Nickel, Steel, Tin and Zinc.

Commodity Futures

A commodity futures contract is an agreement to buy or sell a predetermined amount of a commodity at a specific price on a specific date in the future. Commodity futures can be used to hedge or protect an investment position or to bet on the directional move of the underlying asset.

Many investors confuse futures contracts with options contracts. With futures contracts, the holder has an obligation to act – either to deliver the physical product or take delivery of it.

Although there have been stories over the years of retail futures traders getting a truckload of Corn or Cotton delivered to their front yards, it’s actually a myth, and there are several safeguards to protect traders from this occurring, although these are likely to incur a financial penalty.

Fortunately, when trading CFD commodities, there is no obligation to act.

Commodity Market Participants

We can divide participants in commodity markets into two groups: real participants (producers and buyers) and speculators.

The first group produce commodities for end-buyers that use commodity futures contracts for the hedging purposes for which they were originally intended.

Commodity futures used by companies give a hedge to the risk of adverse price movements. The goal of hedging is to prevent losses from potentially unfavorable price changes rather than to speculate.

Companies that use hedging are typically producers of the commodity or the buyers of that commodity. Farmers, oil producers, livestock breeders, manufacturers, airlines and others may engage in commodity futures markets to hedge against price moves that might negatively impact their business.

The second type of commodities trader is the speculator. These are traders who trade in the commodities markets for the sole aim of profiting from volatile price movements.

These traders never intend to deliver, or take delivery, of the physical commodity when the futures contract expires.

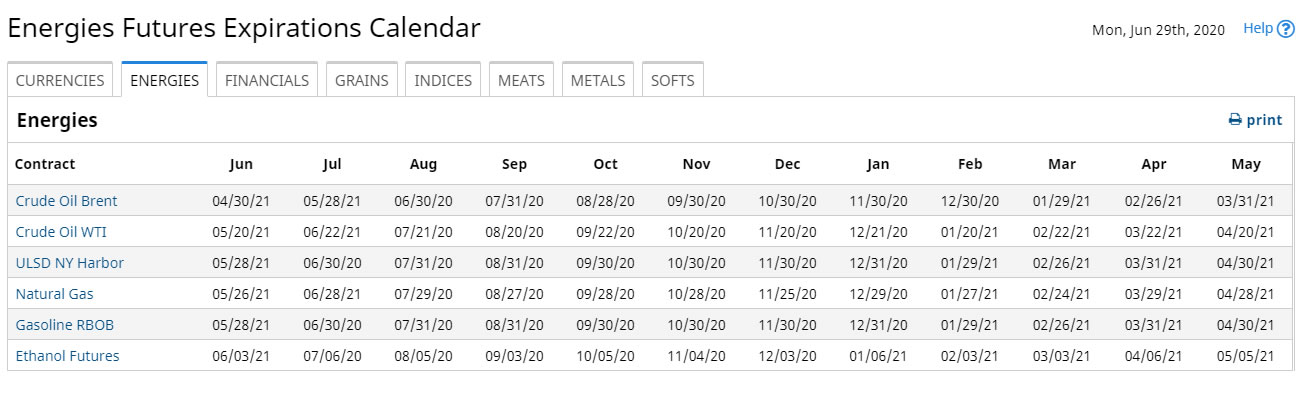

Be aware that rampant speculation can severely distort commodity markets. Also be aware of when contracts expire.

These periods can see heavy volumes as speculators close out futures and options contracts before expiry. Positions are then often re-opened in contracts that expire at a later date.

You can find a useful calendar for futures contract expiry dates on the BarChart.com website (Please note, we are not responsible for third-party content)

(Please note, we are not responsible for third-party content)

Fundamental Analysis

While technical analysis is useful when it comes to commodity trading, a lot of traders tend to focus on fundamental factors.

As we have already seen in a previous lesson, the basis for fundamental analysis is supply and demand.

Commodities trade in cycles. Sometimes supplies will be tight and prices high. Other times, there is too much of a commodity and prices fall as a result.

In general, price movements in commodities using fundamental analysis can be broken down into just two simple formulas:

– If Demand > Supply = Higher Prices

– If Supply > Demand = Lower Prices

These rules do work, but as with everything in trading, it doesn’t mean that you won’t see exceptions. Market are complicated and other factors also influence the price of commodities.

Supply can be influenced by many factors, including weather, amount of acres planted, production strikes, crop diseases, and technological factors.

Demand is the amount that is consumed at a given price level. In general, demand will increase when the price of a commodity is low, and will decrease as the price of a commodity moves higher.

Data Releases

The relationship between demand and supply can be crucial for the price of a commodity, so it is important to monitor data releases.

For example, oil traders may look at the US Energy Information Administration (EIA) weekly change in oil inventories to see whether supply or demand is dictating the direction of the West Texas Intermediate (WTI) crude oil market. A rise in inventories is a bearish sign as it signals that supply is greater than demand.

You can access these reports from the EIA website

Reports on Balance

While changes in inventories could indicate which side drives the market at the moment, reports on balance could confirm or negate those indications. They are published more rarely than reports on changes in inventories, but could carry more important information. For example, OPEC’s monthly report on the situation on the oil market is a type of report on balance.

It shows changes in demand, supply and production and includes forecasts for the future months.

You can download the latest OPEC report from the OPEC website

Many commodities have their own reports that you may want to monitor. The time around publication of these reports usually leads to an increase in volatility, so also be aware of when those reports are published.

Seasonality and Weather

Seasonality is an important part of the fundamental analysis of commodities. While currencies and indices tend to move randomly all over the year, the movement of certain commodities can see specific price moves at specific times of year.

Some commodities, such as corn and wheat, experience price movements due to annual growing cycles. For example, the markets are inclined to push prices lower during harvest time because supply is abundant and risk of weather interference in the yield has dissipated.

Conversely, grain prices are often pressed higher during the planting and growing seasons as speculators price in a weather-risk premium.

Other commodities such as crude oil, natural gas and precious metals don’t have predefined production cycles based on season, but the consumers of these products do.

For instance natural gas sees a rise in price in Autumn as energy providers begin stockpiling for the Winter.

Weather, can also play an important role in commodity markets. The colder it gets, the more expensive natural gas could become as demand surges.

Colder weather could be harmful to crops, which could send prices higher in wheat and other agricultural commodities.